Are tokens good for bootstrapping growth?

Are tokens¹ good for bootstrapping growth? It’s been a popular thesis laid out by leading investors, but it hasn’t led to success. So is the thesis even true?

In this article I’ll explore the entire value chain of token incentives and network effects:

- The thesis of bootstrapping network effects with token incentives

- Network effects 101

- A primer on using tokens to incentivize growth

- Why token incentives don’t work: user motivations

- Why token incentives don’t work: user segments

- Financial analysis of the costs to acquire users with tokens

- Use cases where tokens are beneficial for bootstrapping growth

Using tokens to bootstrapping network growth

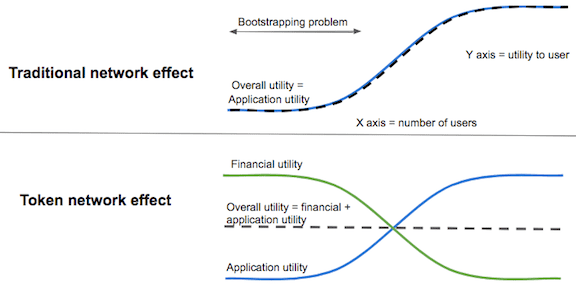

In a 2017 article, “Crypto tokens: a breakthrough in open network design”, Chris Dixon,² a partner at A16Z, lays out the core premise, which he reiterates in his twitter thread:

Essentially, when a network has too few users, you have no utility. Getting over the cold start problem has been a big challenge in web2, and where web3 can shine. While the network doesn’t have any utility value, you give people tokens which have financial value. You pay them to become users of your network.

At some point, when enough users are using the network, the financial incentive isn’t needed anymore and tapers off.

A primer on network effects

Why focus on using tokens to bootstrap network effect growth? What about using tokens to bootstrap regular growth for other projects? That’s been a common theme in web3 as well, especially around GameFi and DAOs. Since users have a vested interest in an increasing token price, you can rely on them to be your marketers and prioritize the product that pays them over other alternatives.

But network effects are special and have attributes other products don’t have.

Network effects 101

In network effect products the value of the network increases the more nodes exist in the network. Telecommunications networks have been the classic example: if you can only call one person, the network is not very valuable. Every additional phone user adds value to the network.

This has two implications for user growth:

- The value of a user to a network grows the more users there are in the network.³ A network that has more users creates, and can extract, more value from its user base. Meaning the value of a user isn’t static, it’s dynamic to the upside.

- User retention is higher since network effect businesses have greater moats. To gain value from a competing product, it has to have a similar sized network.

These two implications mean that a network effects business can probably afford a higher customer acquisition cost (CAC).

Without these dynamics around customer acquisition and long term value, using tokens to bootstrap growth is similar to a referral mechanism or affiliate marketing fee. You’re paying someone to promote a product, much like Dropbox paid users to promote cloud storage. This can work. Usually it doesn’t.

While this topic is interesting, and probably deserves a full analysis of its own,⁴ analyzing the use case of using tokens to grow a network effect product is more revealing for two main reasons.

First, as mentioned already, in network effects users’ value to the network changes and grows, so the bar is lower. All other things being equal, a network effect based product should be able to afford a higher CAC than a non network effect based product because users have more value.⁵

Second, creating a network effect based product is really hard. If tokens can unlock that — that would be huge! Many more products could be built and a new playbook for innovation put into practice.

Network effects, user motivations & user segments

Unfortunately, the thesis around using tokens to bootstrap network effects doesn’t take into account two key aspects of users.

- Misunderstanding human motivations

- Not acknowledging different user segments’ motivations

Money motivation?

Humans don’t do things purely for monetary reasons. When they do, it’s usually about a financial activity — like maximizing income. Paying someone to exercise involves all kinds of motivations: self worth and ego, external appearance, upcoming events. Money isn’t a primary motivator. Because money isn’t the primary motivator, to make it matter becomes a question of making money become the primary motivator — which can be very expensive.

Different people have different motivations. For some, exercise is a powerful motivation. For others, money is. Tokens work on the financial level really well, but don’t work on any of the other ones. This doesn’t mean that if you ask people to put a price on motivating to do an action, they couldn’t. They probably could, it’s that these are completely different problem areas. In economic terms, they’re non substitutable.

User segments

The second behavioral issue not acknowledged in the thesis are user segments. New products follow the technology adoption life cycle. Early users, ‘innovators’ and ‘early adopters’, have different motivations for using a product than later ones.

Early adopters adopt a product for a variety of reasons: they experience the pain point a product is solving for intensely or they like being ahead of the curve. Money isn’t a factor for them.

Financial incentives target users who are not among a products early adopter cohort. Users shift from the more mature ‘early majority’ or ‘late majority’ segments into early adopters before they or the product is ready. This speeds up user growth but because these aren’t the right users, they churn faster, especially when you lower the financial incentive.⁶ I call this the ‘token incentive hump’.

These products never reach the escape velocity they need to go from niche to mass adoption and reach the network effects needed to become successful.

The cost of faster growth

The token incentive hump shows that using token incentivizes can bring faster growth. The question is at what cost. I just touched on the first cost: churning users and never reaching critical mass. But let’s say you want to spend enough tokens so that users use your product to reach critical mass, that’s the ideal after all, how much would that cost?

Mixing different motivations and user segments leads to CAC being much higher than normal. Unsustainably high,⁷ because products are bringing in new users who aren’t the right users.

There’s a beautiful thing about early stage startups. When you build things that don’t scale, you’re starting with the early, early, early adopters. They are, by definition, willing to use a janky product with tons of bugs and glitches, that doesn’t really work well because they have the exact pain point you’re solving. These early customers have a much lower CAC. They’re happier with a less developed product. They’re easier to reach, they’re a niche market. They’re part of the inherent self-selection bias that new products enjoy.

It’s matching the stage of your product to the acquisition channel and profile of your customer. Financial token incentives completely mess that up.

How much does it cost?

Estimating user cost is incredibly difficult, it’s a function of the cost to acquire a customer and customer retention. For example for Facebook you’d need to know how much it costs for Facebook to get someone to signup for Facebook and create a profile and then factor in the retention of how many users keep on using Facebook after 30 days.⁸

It’s hard to estimate CAC and retention costs, it’s easier to estimate how much Facebook as a business can afford to pay. In Q1 2022 Facebook’s average revenue per user (ARPU) was $48 in the US, $15 in Europe and $4 in APAC.

That sets an upper bound for how much a business can pay in tokens incentives to acquire users and bootstrap network effects⁹. You can’t payout more in rewards than you’re bringing in revenue. So even for the most successful network effect companies like Facebook, you have to be incredibly aware of how much money you can spend in tokens. If a mature company with one of the highest ARPU’s in the industry can afford to pay $48 per quarter, how much do you think you can realistically pay?

But token prices can go up!

Maybe you can afford to pay less in tokens because they’ll appreciate in value. You give a user $5 in current token value and users accept it because they think it’s value will increase over time to $50.

Sounds neat but you have to think about the internal value of the tokens. Even if Facebook had done this, even if Facebook had a billion tokens early on and they only gave out a small amount to incentivize the network effects growth 15 years down the line, those billion tokens would still be capped at the value of the network. Prices can’t go up to infinity.

Misaligned incentives: When incentives go wrong

The last problem in the theory is what happens when prices drop? The financial utility use case really only works when prices go up, not when they drop.

When prices drop not only do you not have enough token value to give out in the first place, but the value you’re giving is dropping! Worse, many token holders now hold positions that are mentally underwater. It becomes much harder to incentivize users to use the product, and since token incentives were a major motivator, there’s now nothing holding things together.

Even the organic users, the real users, have lost money and are surrounded by many churning users. The negative flywheel becomes a huge headwind to overcome and a long term token supply overhang.

Where do tokens actually make sense??

So far in this article I’ve covered why using tokens to bootstrap network effects doesn’t make sense. But in some cases, it does. So what cases does the whole thesis hold together?

- Your products’ users are financial users. In other words your users’ motivations are financial motivations. The incentive you’re giving them aligns with the activity and usage you expect in your product. There’s an alignment between the early users the token incentives and the early majority.

- You can pinpoint the right users to distribute tokens to. In other words, you know who the right users to incentivize, and whom not to waste token incentives on. Projects that airdrop tokens have been trying to do this more and more with analyzing users who’ve participated in protocol usage before an airdrop occurs. If you can pinpoint the users most likely to increase the value and spread of the network effect and incentivize them, while not incentivizing others — tokens could well be worth it.

- You’re using tokens to incentivize the right kind of product use, the kind that creates long term value and adoption. This means not incentivizing user growth for user growth sake, or reward farming or passive staking or liquidity providing — but actual use. Actual use that contributes to growing a network effect product.

Combining these three affects, or even getting one of them very, very right, is the right use case for using token incentives to bootstrap network effect growth. It takes nuance and a high degree of knowing your customer to know when the right opportunity comes across your path. Even then, it requires high quality tokenomics to ensure tokens are incentivizing the right activities, in the right amount.

Can tokens be used to bootstrap network effects?

Network effects are hard to bootstrap and get off the ground, but once achieved, are very powerful products. In network effects the value of each additional user to the network increases the value of the network to all other users.

Using tokens to incentivize growth replaces utility as a motivator with finance. Financial versus utility based motivations, in most applications, are very, very different. They have different user bases and different use cases.

While the argument for token incentives to bootstrap network effects states that it’s what’s needed to speed up reaching escape velocity for a network, the reality is that by mixing two different users types, we increase customer acquisition cost to a degree that is unsustainable. While early adopters might be affordable, mature users are not.

By adding financial incentives into a product, you’re adding later stage users that you usually can’t afford and will churn.

The other large externality that’s often forgotten is that token prices fluctuate. Just as you think you’re adding positive expected value when token prices go up, you could just as easily be adding in negative expected value when token prices drop. Which can kill your product.

There are a three cases where token incentives make sense:

- Your products’ users are financial users

- You can pinpoint the right users to distribute tokens to

- You’re using tokens to incentivize the right kind of product use

At the end of the day, the technology adoption life cycle, as it was laid out by Everett Rogers, is a model that needs to be adhered to. New products are used by early adopters and their motivations are drastically different from the motivations of the rest of the market. Network effect products need to adhere to this framework just like any other. Token incentives mess this up more often than not.

I design tokenomics for crypto protocols and am putting everything I’m learning into a super in depth Tokenomics course.

If you’re interested in my free email tokenomics course sign up!

1. Tokens throughout this article refers to non stablecoin tokens, and specifically tokens that are associated with the product. 2. This article isn’t meant at all to ‘bash’ Chris Dixon’s writing. I’m a fan of his ideas and writing. He’s without a doubt a thought leader in the space, writing and publishing about concepts before others, and shaping the industry dialogue and terminology. I do think his posts require more nuance and the unbridled optimism in much of his writing sways market participants too much away from first principles and independent thought. Which leads to a lot of the market bubbles we experience in crypto. 3. Until critical mass is reached after which additional users increase the utility but marginally — the 10 millionth user on FaceBook is more valuable than the six billionth. 4. Affiliate marketing and referral structures exist today in many products. It fails far more often than it succeeds. Paying people to promote your product is usually more expensive than you’d imagine because it mixes different motivations together, and financial motivation is only part of the mix — usually a small one.Andrew Chen from A16Z has written about referral marketing and ‘viral’ marketing extensively both in regular growth terms as well as in network effect terms. This essay is a good place to start. His core concepts and analysis are fantastic, but I would read his writings with a critical lens regarding CAC, a point he doesn’t address enough in my opinion in regards to viral loops and marketing schemes.Promoting a product is rarely a purely financial motivation — there’s personal reputation on the line, relationships and time, energy and attention constraints. The affiliate marketer is constantly making a calculation in their minds whether the fee they’re getting paid is worth all of these factors. Usually they’re not worth enough to do the marketing legwork to get a customer to convert. The one key difference is that paying someone in tokens versus fiat currency is different. Tokens have larger up and downside. If the token price is tied to the overall value of the network, through a burn or profit sharing mechanism, then the value of the token can increase over time (although then it starts looking more like a security as per the Howey Test).If a tokens value is directly connected to the revenue of a protocol or product, for or example Sushiswap where $SUSHI holders can get paid a percentage of the Sushiswap protocol revenue, paying in tokens also means paying someone with a piece of the pie that gets bigger the more people join. The equivalent would be paying someone an affiliate fee that’s structured as ‘$5 + 2% of overall revenue’. Or simply by giving someone shares in a company. Easy to do with publicly traded companies and extremely hard to do in private ones. 5. All else being equal — as in products in the same market, targeting similar customers etc. 6. Which is inevitable unless you have a never ending pile of money (in which case the value of the money would be inflated away anyway). 7. While that feels fine for early stage crypto projects because they’ve “created a token out of thin air” but they’re wrong. It’s not free. It’s coming at the expense of your future tokenomics and token wellbeing — see point 6 above. 8. 30 days is an arbitrary number I chose although it makes sense for a social media company. Every industry has different retention metrics. 9. This is a generous upper bound: these are a revenue number, not profits.

Designing Tokenomics by Yosh Zlotogorski

Web3 Research

📑 Blog