Why token prices drop

Most crypto projects’ tokens drop 90%+ within two years of launching. Why? It’s the supply and demand! Isn’t that why prices drop everywhere? Too much supply, not enough demand?

True, but in this article we’re going to dive deeper into how tokens allocated to insiders consistently prove to be the bane for web3 projects’ token prices.

Like clockwork, when the vesting period for insiders ends, supply floods the market, demand doesn’t catch up and token prices slump.

Vesting and the supply/demand imbalance

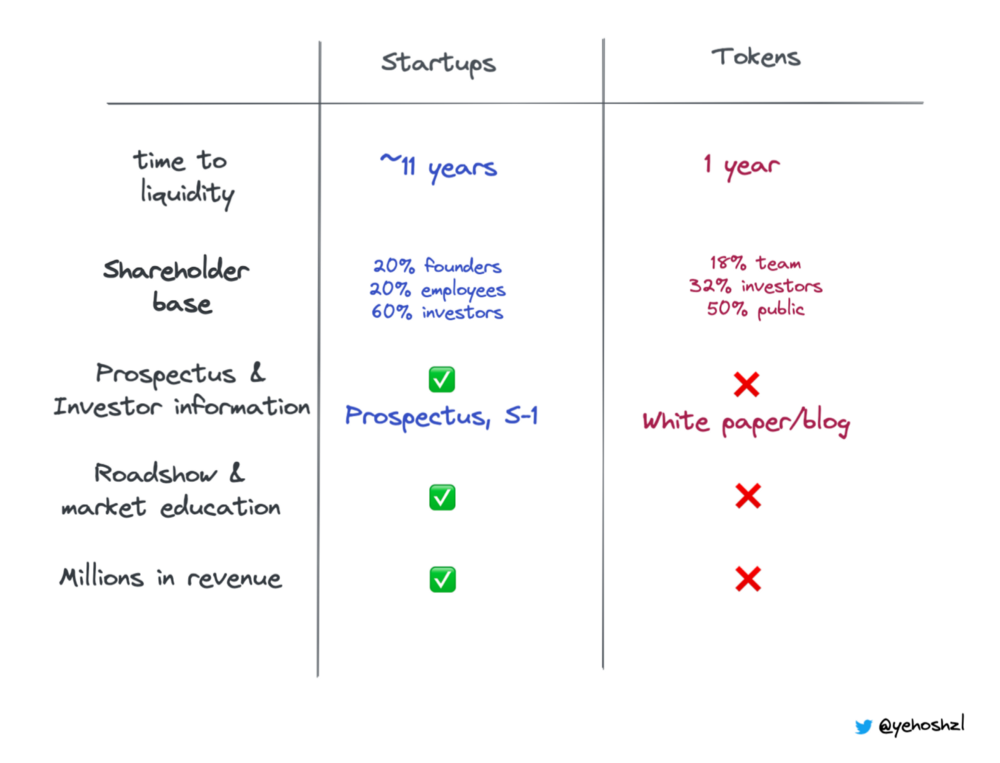

Treating token vesting like startup equity vesting has become common practice among web3 projects and DAOs. Unfortunately, treating tokens like startup equity is a mistake. They are very different mechanisms, with different liquidity profiles and ‘jobs to be done’.

The contradiction is simple: startup equity works because it’s locked up and aligns incentives for the long term. Tokens are liquid and therefore don’t align incentives for the long term. They can be sold, traded, or staked years before the project or DAO has reached maturity. Let’s see how you can analyze a project to avoid a 90% drop in a token.

Token distribution: to whom, when and how much

The first step is analyzing whom is owed how much of a token, and when they’ll vest. Essentially you need to understand the distribution. Here is an example one of the better DeFi projects out there: Liquity Protocol.

Liquity launched with a hard cap of 100 million $LQTY tokens. Here is the genesis distribution:

57.6% of tokens are allocated to insiders including the team and investors. 41.4% is allocated to the community, 1% to service providers. The top line sounds decent, with 41.4% going to the community. While some DeFi projects assign more to their community and less. to the insiders, that’s better than most startups for sure.

But you need to dive deeper to get the tokenomics understood properly. The community block is divided into two. 8.1% of tokens are allocated to the community reserve and endowment. These allocations are under the control of the Liquity team — we don’t know when or for what they’ll be spent. They could be spent all at once on a big marketing initiative or held in escrow for years. That’s a large supply overhang we have to deal with.

33.3% of $LQTY is allocated to the community on an algorithmic basis, using the same algorithm that Bitcoin uses, where issuance is halved. In the case of LQTY, halving events occur every six months instead of four years. This also sounds good — inflation will drop much faster than in the case of Bitcoin, which means that LQTY holders will be diluted less. But there’s a catch.

While 33.3% sounds like a lot of the supply that we can forecast properly, it pales in comparison to the 57.6% of tokens that insiders control. To get a full picture of the supply coming online, we have to look at the insider vesting schedule.

Insider vesting schedules

Liquity is a transparent protocol, so fortunately, we can find all the details for the vesting in their documentation.

The 57.6% allocated to insiders have two very different lockup schedules. The team receives a quarter of its 23.7% after 12 months, and thereafter 1/36 each month. The investors on the other hand receive all their tokens after 12 months.

Unlike in startups, both parties can immediately sell or stake their tokens after 12 months. This is completely different than the classic use of ‘vesting’ in startups, where the equity is earned during the vesting period but never liquid.

Indeed, this dramatic difference in meaning and usage between web3 and startup equity leads to a huge increase exactly one year after the LQTY launch when a quarter of the teams ownership is unlocked and the entire investor stake is unlocked. With devastating repercussions for the price and retail holders of $LQTY.

Calculating token supply and demand

Let’s analyze the supply and demand dynamics for $LQTY from launch through the first year and a half of the protocol.

Analyzing the first year

Let’s start with analyzing supply. During the first 12 months of Liquity’s existence. $LQTY is supplied and circulated on the market through three distribution mechanisms:

- LQTY community rewards for the stability pool: This is 32% of the total token supply, which is distributed to people who provide a core function of the protocol. The distribution follows a 12 month halving schedule, so during the first 12 months 16 million LQTY are distributed

- 1.3 million LQTY is distributed during the first six weeks to liquidity providers on DEXs

- 2 million LQTY is earmarked for the community reserve and can be distributed.

This brings us to a to a maximum circulating supply of 19.5 million LQTY during the first year of the protocol.

What’s behind the demand for LQTY? As I laid out here, demand comes from four things:

- Token Utility

- Memes

- ROI

- Governance

Liquity protocol is immutable, with no governance, so let’s scratch that off the list. Memes and a strong narrative haven’t quite coalesced around $LUSD, the core functionality of the protocol (although it’s starting to as $LUSD is arguably the only truly decentralized stable coin left). Which leaves us with token utility and ROI.

The utility LQTY grants is a revenue share of the Liquity Protocol. That’s the only utility it gives, and so in this case ROI and utility are one and the same. So what ROI was it granting during the first 12 months?

During the first 12 months, protocol revenue was ~$24 million. Since that revenue is distributed to LQTY stakers, there’s a clear connection between how many stakers are out there and the ROI. With 15.5 LQTY in circulation, assuming everyone stakes, that’s an annual distribution of $1.5. That yield served as a demand floor for the token.

And while LQTY traded together with all of DeFi and crypto and took a large tumble, throughout most of 2021, it found a decent floor around the ~$5 mark. But what happened when month 13 came around and supply hit the market?

The supply-demand imbalance

When May 2022 hits, a lot of supply comes into the market. All of investors, advisors and the community endowment funds are now unlocked, as well as a quarter of the teams’ $LQTY. Together that’s: 5,916,158 + 33,902,679 + 6,063,988 + 1,035,367 = 46,918,192 million tokens that hit the market all at once during month 13.

On day 365 of the project we had 15.5 million tokens in circulation. On day 366 we’ve 3x that. Tokens in circulation have grown 300% in one day. On the other side of the equation, demand hasn’t grown nearly at that pace. Protocol revenue has barely budged from ~$24m. This causes a huge mismatch between supply and demand.

What DeFi has going for it which shouldn’t be taken for granted, is its transparency. Due to the Liquity team being completely transparent, it’s possible for retail token holders to see the supply dump coming, and indeed selling of $LQTY started early in 2022 and picked up steam during April, right before the supply unlock.

If you’re thinking, “great! all the tokens are unlocked, the market has priced it in”, it’s not so simple. Most of the tokens that got unlocked didn’t get sold on the market — investors aren’t that stupid — and preferred to wait for better prices. So where did those tokens go? Into the LQTY staking pool. The LQTY staking pool grew 3x from May through August — in line with the growth of circulating tokens.

Unfortunately, this has a huge, dampening affect on the price of $LQTY as the same amount of protocol revenue is now being distributed to 45 million tokens, instead of 15 million ones. This means that the yield and ROI has been reduced dramatically. Giving buyers less of a reason to buy the LQTY token.

Why token prices drop 90%

While all crypto tokens trade with a very high correlation, as time goes by, the wheat will separate from the chaff and good tokenomics will be critical for project success.

The tokenomics of the Liquity protocol never accounted properly for the supply and demand imbalance that would occur exactly one year after the the token launched, and the results are easily foreseen. A 300% increase in token supply can never be covered by the growth in the protocol use. Only the best of the best startups achieve that kind of year over year growth. The mismatch in supply and demand floods the market with liquidity and inevitably, the token price drops. Worse, the supply overhang will take years to be worked out of the market.

While Liquity Protocol is a fantastic protocol and product, the tokenomics doomed the price and adoption of $LQTY from day 1, and it will take a long time for the protocol to shake off the repercussions.

I design tokenomics for crypto protocols and am putting everything I’m learning into a super in depth Tokenomics course.

If you’re interested in my free email tokenomics course sign up!

Designing Tokenomics by Yosh Zlotogorski

Web3 Research

📑 Blog