Tokenomics supply & demand 101

Tokenomics, or token economics, is one of the most important parts of any web3 project. Whether you’re an investor or a builder, understanding tokenomics is critical to success. In many ways the ability to add a financial incentive and layer into technology protocols (i.e tokens) is THE innovation that crypto and web3 bring to the table. Tokenomics is what enable Bitcoin to provide a decentralized store of value and Ethereum a distributed compute network.

Tokenomics is built of two key factors: understanding what purpose your token serves and the different aspects affecting the supply and demand for the token. These are the core building blocks of who uses your token and why.

Once you’ve understood the why behind using a token in a web3 project, it’s time to get a better understanding of the other key aspect of tokenomics: supply and demand. In this article I’ll break down the properties that make up supply. In Part two I’ll cover demand. This is a ‘101’ breakdown. By the end of it you’ll be able to evaluate a project from all angles — whether you’re a builder or a buyer. The two parts will cover:

- Part 1: Core supply factors: total token supply and inflation, distribution to insiders and the public and how staking plays into it.

- Part 2: Core demand factors: measuring token utility, ROI, memes and governance

Token supply and demand come down to a few elements. At a high level it’s very simple, yet understanding the low level intricacies to get your tokenomics right is very hard.

What makes up token supply

Every projects’ token supply is composed of a few things:

- Total token supply

- Public initial distribution and issuance rate

- Insider distribution and vesting

- Staking & locked up tokens

Total token supply

Total token supply is the number of tokens the project has including inflation. Nat Eliason put it very well:

Is it a fixed 21 million supply rate like Bitcoin or is there an initial supply with yearly inflation like Audius, which launched with one billion coins and a steady inflation rate? The total number of coins in your project doesn’t matter that much. There can definitely be a mental affect to having a larger number of coins, but the number of coins doesn’t impact the fundamentals, in a similar way that stock splits affect investment sentiment but not the fundamentals of a company.

What does matter is the inflation rate of the tokens. The higher the inflation rate, the more dilutive for long term holders. If Audius has a 7% inflation rate in future years, that means all other token holders are suffering from 7% dilution.

That’s a lot of dilution on an annual basis. It means two things. First that unless your ROI is at least 7% per year, as in, equal to the inflation rate, you’re losing purchasing power with your token. That can mean less utility, governance rights, staking yield or just losing purchasing power in dollar or ETH terms. The second implication is that your ROI has to be that much higher to be real. If before a 7% yield would have been enough, now you’ll need 7%+ to have a real return.

Ironically, while inflation matters a great deal long term, most crypto projects haven’t survived long enough to reach inflation driven problems. They die first by mismanaging their initial distribution and supply issuance: not understanding how many tokens are available now and how many are coming on to the market over the next few months. This requires understanding the initial distribution.

Public initial distribution and issuance rate

Public initial distribution and issuance rate is how many tokens get distributed to the public and how fast your tokens get into the publics hands. As in, not early insiders, but to your community. In Bitcoin this number would be the coins that aren’t held by very early HODLrs and that miners don’t hold and sell on the market.¹ Because of the selling pressure miners face in Bitcoin to fund their mining and real world costs, this rate is roughly equivalent to the overall Bitcoin protocol issuance rate: a halving of coin issuance every ~four years.

But other coins have different public issuance rates. UNI started with an initial community supply of 172 million (17% of the total planned four year issuance). The community supply was planned to grow 75%, 28.5% and 11% in years one through four respectively.

Public initial distribution and issuance rates matters a lot. These are the coins that are actually circulating in the market during the first few months and year of a project. This is the entire supply that the market can access. If you there isn’t enough supply early on, there are dynamics for an artificial pop — which can easily crash later on if demand doesn’t catch up. This bucket of supply is also the least controlled part of the tokens: there is no token contract setting the token dynamics. Users can do with them as they wish.

Insider distribution and vesting

Insider distribution and vesting is the most opaque of the three, and can be the most impactful. How many of the tokens have been given to investors and team members? When can they sell them on the market? When can they stake them or use them to participate in governance? Insider token allocation in many projects stands at ~40% from the total supply. In the first two years of launch, insiders stake can represent a much higher percentage of the circulating float.

Having a grasp on the insider vesting and distribution schedule will help you understand how many tokens will enter the circulating supply on the market.

For example, in Liquity protocol’s case, in month 13 ~50% of tokens supply come on market from insiders alone. So despite Liquity having no long term inflation and a hard cap of 100 million tokens anyone holding tokens during the first year can expect a 3x increase in circulating supply after the first year.

Staking & token lock ups

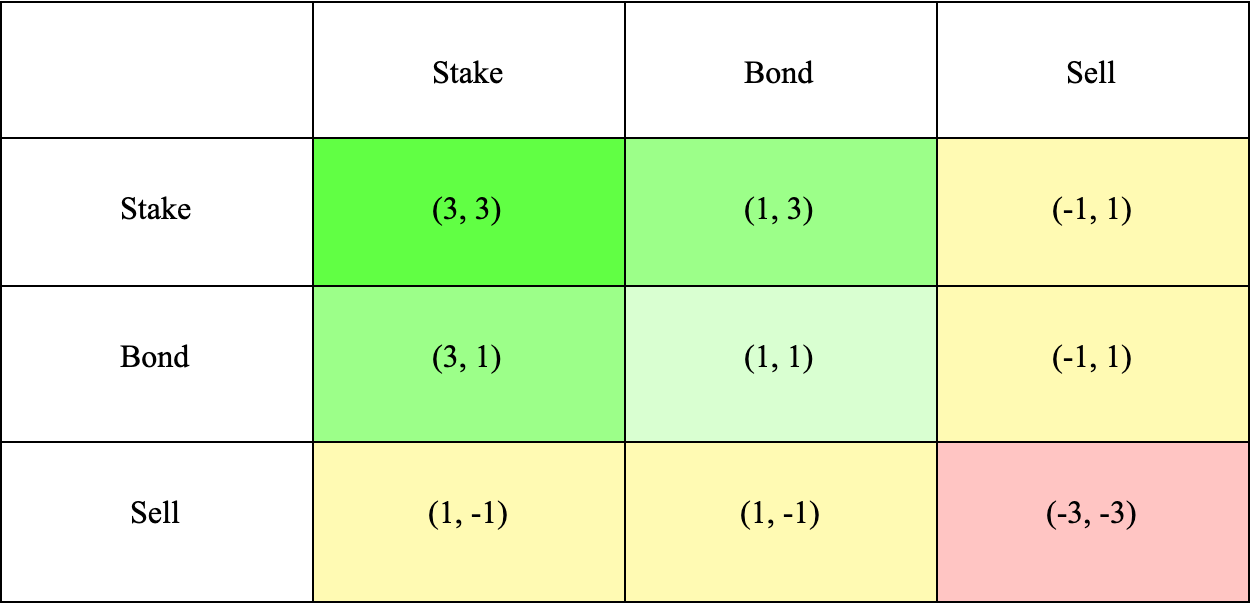

Staking (or locking up tokens in other ways) is a common method used to artificially constrain supply. Why not simply reduce the overall supply? By introducing staking projects believe they get to enjoy the best of both worlds: distributing tokens to many stakeholders who will become involved in the project while still not over flooding the market with supply. Projects hope that token holders will take yield in exchange for liquidity. OlympusDAO was the best example of this with the (3,3) meme they propagated. (3, 3) means that if, in theory, everyone holds their tokens, everyone wins. No supply enters the market, price goes up, all the holders profit.

Unfortunately, it’s more complicated, since to convince someone to stake, you have to cover their opportunity cost, which can cost a lot. This is why many projects find themselves paying a ridiculously high APY to stakers, which in turn increases supply too much. This was also the fate of OlympusDAO and the (3, 3) meme.

OHM, OlympusDAO’s token eventually went into the (-3, -3) bucket as the yield and promises of OlympusDAO couldn’t convince holders to keep holding (it’s a story worth going into covered by Jordi Alexander)

Tokenomics Supply & Demand 101

Understanding what goes into a tokens’ supply and demand characteristics are the basis for evaluating the prospects of a web3 project. Once it’s clear that a token is being used for the right reason, and it has the potential to capture real world value, it’s time to understand what goes into the supply and demand of the token: the utility it delivers, to whom and how much. What reason people have for holding it and using it? How much supply is out there and at what rate is it being issued.

In part of Tokenomics 101 I covered the different dynamics that go into a tokens supply. Each of these topics deserves a deeper dive, but if you’ve made it this far, you’re well on your way to being able to fully evaluate a project for yourself. In part 2 of Tokenomics 101 I’ll cover the demand side of the equation and touch on the point where supply and demand meet.

I design tokenomics for crypto protocols and am putting everything I’m learning into a super in depth Tokenomics course.

If you’re interested in my free email tokenomics course sign up!

1. While these aren’t officially insider participants in Bitcoin, for all intents and purposes of a tokenomics analysis, I consider miners and early HODLrs to be “insiders” because they’re the group in Bitcoin who receive Bitcoins from the protocol and hold enough to impact the market supply currently.

Designing Tokenomics by Yosh Zlotogorski

Web3 Research

📑 Blog